Financial Therapy for Couples in California: Transform Money Stress Into Partnership

Why California's Financial Pressures Are Breaking Relationships Apart

Money conflicts destroy relationships, and California couples face unique financial challenges that make achieving financial well being even more difficult. With median home prices exceeding $800,000 in many counties and living costs consuming nearly half of household income, financial stress becomes an emotional battleground that tears apart even the strongest partnerships.

Financial counseling for couples in California addresses these complex money management issues by recognizing that financial conflicts are rarely about the actual dollars and cents. Instead, they stem from deeper emotional patterns, unconscious beliefs, and automatic responses that develop over years of financial stress and past experiences with managing money.

I'm Audrey Schoen, a Licensed Marriage and Family Therapist specializing in financial therapy for couples throughout California. From my practice in Roseville and through secure online sessions, I help anxious overachievers transform their relationship with money from conflict to collaboration. With specialized training as a Certified Master ART Practitioner in Accelerated Resolution Therapy, plus expertise in Brainspotting and Relational Life Therapy, I address both the emotional and practical aspects of financial partnership to improve your overall financial situation.

The Hidden Psychology Behind Money Conflicts

Living in California, or other high cost of living places, means confronting financial challenges that couples in other states may not experience. When you're spending half your income just to keep housing, and unexpected costs like insurance can double overnight, money stops being a practical concern and becomes a survival issue that triggers deep emotional responses about your financial future.

The couples I work with often describe feeling trapped in repetitive arguments about finances that never seem to resolve. One partner might say, "You always overspend on groceries," while the other responds, "You never want to enjoy anything we work for." These surface-level conflicts about personal finances mask much deeper emotional patterns that financial counseling helps uncover and heal.

Money Scripts: The Unconscious Beliefs Driving Financial Issues

Everyone carries what researchers call "money scripts"—deeply held beliefs about money that usually develop in childhood and operate unconsciously in adult relationships. These scripts create automatic emotional responses that can sabotage even the most well-intentioned financial planning efforts and damage your financial life.

Money avoidance shows up as believing wealthy people must be greedy or that money corrupts relationships. People with this script often undercharge for business services, avoid financial planning entirely, or feel genuine guilt about building financial security.

Money worship involves believing money will solve all problems and bring happiness. This can lead to workaholism, chronic overspending, or neglecting relationships in pursuit of wealth and assets.

Money status means using financial success to define self-worth and social standing. This often creates competitive spending, keeping up appearances regardless of cost, or linking personal identity directly to credit scores and net worth.

Money vigilance involves extreme caution with spending and constant worry about financial security. While this can create good savings habits, extreme vigilance can also generate anxiety, hoarding behaviors, or relationship conflicts over any spending decisions.

Understanding these unconscious patterns is crucial because they often create the emotional charge that makes conversations about finances so difficult and prevents couples from achieving their financial goals.

Cultural and Family Money Patterns

California's diverse population means couples often bring vastly different cultural approaches to money management into their relationships. Some families treat financial discussions as deeply private or shameful, leaving people unprepared for the transparency healthy financial partnerships require. Others may have experienced financial instability that created lasting anxiety responses around managing money and credit.

Upbringing clashes create particularly intense financial issues. Imagine one partner who grew up with financial scarcity, where every purchase required careful consideration and savings were essential, paired with someone whose family had abundance and made spontaneous buying decisions. They're operating from completely different emotional frameworks about what money means and how finances should be handled.

How Financial Therapy Transforms Relationships

Financial therapy for couples in California takes a radically different approach than traditional financial planning or budgeting advice. While financial planners focus on investment portfolios and retirement calculations, financial therapy addresses the emotional roots of money conflicts that keep couples stuck in destructive patterns around their finances.

Unlike financial coaches who primarily offer guidance on budgeting and savings strategies, a financial therapist addresses the psychological aspects of your financial life. This comprehensive approach helps couples understand why they struggle with money management despite having access to financial education and resources.

My Specialized Approach

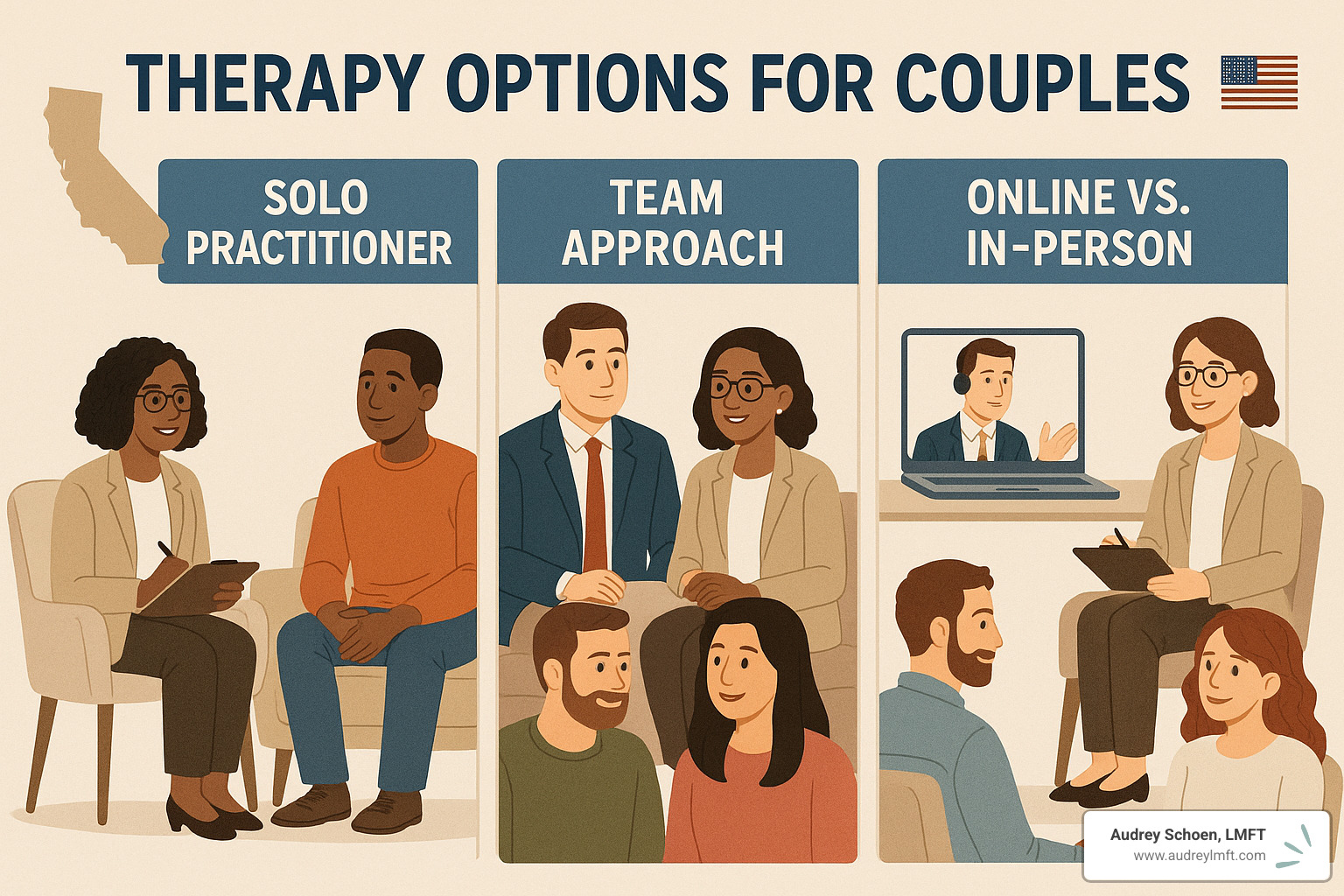

As a solo practitioner, I provide personalized financial counseling that integrates three powerful therapeutic modalities specifically chosen for their effectiveness with money-related stress and relationship conflicts around finances.

Relational Life Therapy helps couples understand how individual psychological patterns show up in their financial partnership. When someone has perfectionist tendencies, they might become paralyzed by financial decisions or overly critical of their partner's approach to managing money. RLT helps identify these patterns and develop healthier ways of relating around finances and long term goals.

Accelerated Resolution Therapy rapidly resolves specific money-related traumas or anxieties that interfere with your financial well being. Whether it's childhood financial instability, job loss trauma, or anxiety about making financial decisions, ART helps process these experiences so they stop interfering with current financial choices. As a Certified Master ART Practitioner, I've seen clients experience significant relief from money anxiety in just a few sessions.

Brainspotting addresses the physical responses that financial stress creates in the body. When your heart races checking credit reports or you feel nauseous during budget discussions, traditional talk therapy alone might not create lasting change. Brainspotting helps release these trauma responses stored in the nervous system that impact your financial future.

The Comprehensive Assessment Process

Every couple's financial therapy journey begins with a detailed intake process that goes far beyond typical relationship counseling. I use comprehensive assessment tools that measure both financial behaviors and relationship patterns, creating a baseline for tracking progress throughout our work together on your financial life.

During the initial session, we explore each person's financial history, including family-of-origin money patterns, significant financial experiences, and current triggers around managing money. This isn't just gathering information—it's helping couples understand how their individual money stories create their current relationship dynamics around finances.

Goal-setting moves beyond vague wishes like "fight less about money" to create specific, measurable financial goals with realistic timelines. We explore what financial security actually means to each partner, often revealing that they have completely different definitions of financial success and different approaches to financial planning.

Practical Tools and Good Communication Skills

Financial therapy combines emotional healing with practical skill-building around money management. The feedback wheel communication technique gives couples a structured way to discuss finances without triggering defensive responses. This tool helps partners share feelings about financial decisions without blame or criticism, replacing destructive argument patterns with productive problem-solving around their financial situation.

Values alignment work helps couples understand that different approaches to managing money often stem from different core values, not character flaws. When one partner values security through savings and the other values freedom through spending, their financial decisions will naturally conflict until they find ways to honor both values in their financial life.

Debt management becomes much more effective when we address the shame and anxiety that often created the debt in the first place. Many couples get stuck because one person feels too guilty to engage with credit reports and finances while the other becomes controlling and critical about spending and savings.

What Makes California Couples' Financial Challenges Unique

California's economic landscape creates specific financial issues that require specialized understanding. The state's high cost of living means that even successful professionals often feel financially unstable despite good income. Tech industry income volatility creates feast-or-famine cycles that make financial planning and savings challenging.

Student loan debt frequently reaches six figures for professionals building careers here, impacting their ability to save for retirement planning or build other assets. The pressure to maintain California's lifestyle expectations while building financial security creates chronic stress that shows up as relationship conflict about finances.

Real estate decisions carry enormous emotional weight when homes cost four times the national average. Couples find themselves making the largest financial decisions of their lives under extreme pressure, often triggering deep anxieties about security, credit, and their financial future.

Entrepreneurial couples managing their own business face additional complexity, from unpredictable income streams to managing both personal and business finances together. They need specialized guidance on how to separate business and personal financial goals while maintaining good communication about money.

The Treatment Process: What to Expect from Financial Services

Financial therapy typically unfolds over several months, with the exact timeline depending on each couple's specific financial issues and goals. Most couples notice calmer, more productive conversations about finances within the first month of consistent work with a qualified financial therapist.

Session Structure and Frequency

For couples work, I recommend 80-minute sessions that allow time to explore complex emotions and practice new communication skills around managing money. We often meet every two weeks, giving couples time to practice new approaches between sessions while maintaining therapeutic momentum around their financial goals.

I ask for a three-month initial commitment that includes both in-session work and practicing new tools at home for managing finances. This timeframe allows us to address surface-level conflicts, explore deeper patterns, and begin building sustainable new habits around money management and financial planning.

Progress Tracking and Measurement

Throughout our work together, I use detailed measurements to track progress in both financial behaviors and relationship satisfaction around finances. This isn't just about feeling better—it's about creating concrete improvements you can see and measure over time in your financial life.

Progress reviews happen regularly, typically every three months, using the same assessment tools from your intake. This allows us to track improvements objectively and adjust our approach as needed to better support your financial well being and relationship goals.

Specialized Work for Different Life Stages and Financial Situations

Premarital and Newlywed Couples

Starting financial therapy before or early in marriage can be one of the most valuable investments a couple makes in their financial future. Financial intimacy development teaches couples how to be vulnerable and transparent about money in ways that deepen emotional connection around their finances.

Prenuptial discussion preparation helps couples navigate these sensitive conversations with clarity and compassion about assets, debt, and financial goals. Rather than approaching prenuptials as protection against relationship failure, we frame them as tools for mutual understanding and protection of your financial life together.

We also address retirement planning conversations early, helping couples align their long term goals and understand how their individual financial decisions impact their shared financial future. This includes discussing savings strategies, investment approaches, and how to manage credit together.

Established Couples Facing Financial Transitions

Major life changes—career shifts, home buying, starting families, caring for aging parents—often trigger financial stress that overwhelms existing coping strategies for managing money. Financial therapy provides tools for navigating these transitions while maintaining relationship connection and working toward your financial goals.

Generational wealth planning explores how couples want to build and transfer assets across generations, including conversations about children's financial education and breaking negative money patterns that may have been passed down through families. We also discuss retirement planning and how to build long-term financial security together.

Beyond the Therapy Room: Building Long-Term Financial Well Being

The real transformation happens when couples integrate insights from therapy into their daily financial life. Financial intimacy isn't a destination you reach—it's an ongoing practice that requires consistent attention and care around how you manage finances together.

Creating Sustainable Systems for Managing Money

Monthly money dates create space for financial intimacy without crisis management pressure. These aren't emergency meetings to fight about overspending—they're planned conversations to review progress toward financial goals, celebrate wins, and adjust course as needed with your savings and budget.

Transparent financial systems mean both partners can access complete information about finances whenever needed. This goes beyond sharing passwords—it means creating systems where accounts, credit scores, investment balances, and debt levels are visible to both partners, supporting good communication about your financial situation.

Regular expectation check-ins acknowledge that financial needs and priorities change over time. What felt fair when both partners had stable income might need adjustment when someone changes careers, starts a business, or returns to school, impacting your overall financial life and goals.

Addressing Ongoing Money Anxiety and Financial Issues

When money anxiety continues interfering with progress toward financial goals, the trauma-informed modalities I use can provide rapid relief. If someone breaks into a sweat checking credit reports or feels physically sick during budget discussions, these aren't character flaws—they're treatable anxiety responses that impact financial well being.

Accelerated Resolution Therapy can quickly resolve specific money-related traumas, while Brainspotting addresses the physical stress responses that financial pressure creates in the nervous system, helping you better manage finances without overwhelming anxiety.

Financial Education and Building Financial Literacy

While therapy addresses the emotional aspects of money conflicts, financial education remains important for building practical skills around managing money. I may provide foundational guidance on understanding credit reports, improving credit scores, creating effective savings plans, and developing realistic budgets that support your financial goals.

However, unlike financial coaches who focus primarily on technical skills, my approach integrates emotional awareness with practical money management. This ensures that the financial education actually gets implemented rather than abandoned when emotional triggers arise around finances.

We explore resources for continuing your financial education beyond our sessions, including reputable sources for learning about retirement planning, investment strategies, and debt management that align with your values and support your long term goals.

Getting Started with Financial Therapy Services

If repetitive arguments about finances are wearing down your relationship, if financial anxiety affects your sleep or connection with your partner, or if you want to build a stronger foundation for your financial life together, financial therapy can provide the clarity and tools you need.

Every couple's financial situation is unique, which is why personalized approaches work better than one-size-fits-all solutions. During our initial consultation, we'll explore your specific financial challenges and goals, helping you understand how financial therapy might address your particular needs around money management and relationship concerns.

What to Look for in a Financial Therapist or Counselor

When choosing a financial therapist in California, look for a Licensed Marriage and Family Therapist with specialized training in financial therapy. Experience with trauma-informed modalities like Accelerated Resolution Therapy or Brainspotting can be particularly valuable because many money issues stem from past experiences that continue influencing present behavior around finances.

While some professionals combine credentials—such as financial planners who also provide counseling services—what matters most is finding someone who can address both the emotional and practical aspects of your financial life. Be wary of quick-fix promises or providers who focus only on budgeting tips without exploring underlying beliefs and emotional patterns around money.

A qualified financial therapist should be able to assist you with both immediate financial concerns and longer-term relationship patterns, providing guidance that supports your overall financial well being and helps you manage the unique challenges of your financial situation.

Making the Investment in Your Financial Future

The investment in financial therapy often pays for itself quickly through better financial decisions and reduced money stress. More importantly, you develop skills that serve your relationship for decades to come around managing money and achieving financial goals together.

Getting help isn't admitting failure—it's choosing your relationship over pride. It's recognizing that some financial issues require specialized support from qualified professionals, and that investing in your partnership is one of the smartest financial decisions you can make for your future.

Transform Financial Stress Into Partnership

Money problems don't have to destroy your relationship. While California's unique financial pressures create real challenges for couples around income, housing costs, and building savings, the right support can transform financial stress from a source of conflict into an opportunity for deeper connection around your shared financial life.

Financial therapy works because it addresses what's really happening beneath recurring arguments about finances. When you understand the fear, anxiety, and unconscious patterns that get triggered when financial pressure hits, everything changes in how you approach money management and financial goals together.

As a solo practitioner specializing in helping anxious overachievers find calm and connection, I've witnessed countless couples move from financial chaos to genuine partnership around their finances. The change happens when we combine practical money management skills with emotional healing—addressing both the budget and the feelings that make it so hard to stick to that budget.

From my Roseville location and through secure online sessions throughout California and Texas, I work with couples who are tired of the same financial fights and ready for real solutions to their money management challenges. Whether you're newlyweds wanting to start strong with your financial life together, established couples dealing with chronic conflicts about finances, or partners facing major financial transitions, personalized financial therapy can provide the clarity and tools you need.

Financial harmony is possible, even in California's challenging economic landscape. With the right support and guidance, you can build both the practical skills and emotional intimacy that create lasting financial partnership. You don't have to figure out money management alone, and you don't have to keep having the same fights about finances, savings, and spending.

Contact my practice today to learn how financial therapy can transform your relationship with money and each other. Let's explore how specialized counseling services can assist you in building the financial future you want together, addressing your specific concerns about money management, and creating lasting positive change in your financial life. I'm here to provide the professional guidance and support you need to achieve your financial goals while strengthening your relationship.

Through personalized therapy sessions, we'll work together to develop the communication skills, money management strategies, and emotional tools that support both your financial well being and relationship satisfaction. Your financial future starts with the decision to seek help and invest in professional services that can truly make a difference in your life together.